Upgrading your heating system or new heating installation can seem like a significant expense, but individuals and businesses in Brooklyn, Queens, Manhattan, and Staten Island can greatly benefit from federal tax credits and rebates. Now is the perfect time to upgrade your heating system with rebates currently offered by Con Edison, a $2,000 federal tax credit, and an exclusive Arnica rebate of up to $3,000.

Why Upgrade Your Heating System?

In addition to being more energy efficient, modern heating systems are also environmentally friendly. Switching to a modern heating system can significantly reduce your carbon footprint, lower your energy costs, and enhance interior comfort. Additionally, in accordance with New York State’s Clean Heat Program, these enhancements make homes and businesses eligible for additional incentives.

Available Rebates and Tax Credits for Heating Installation in Queens and Staten Island

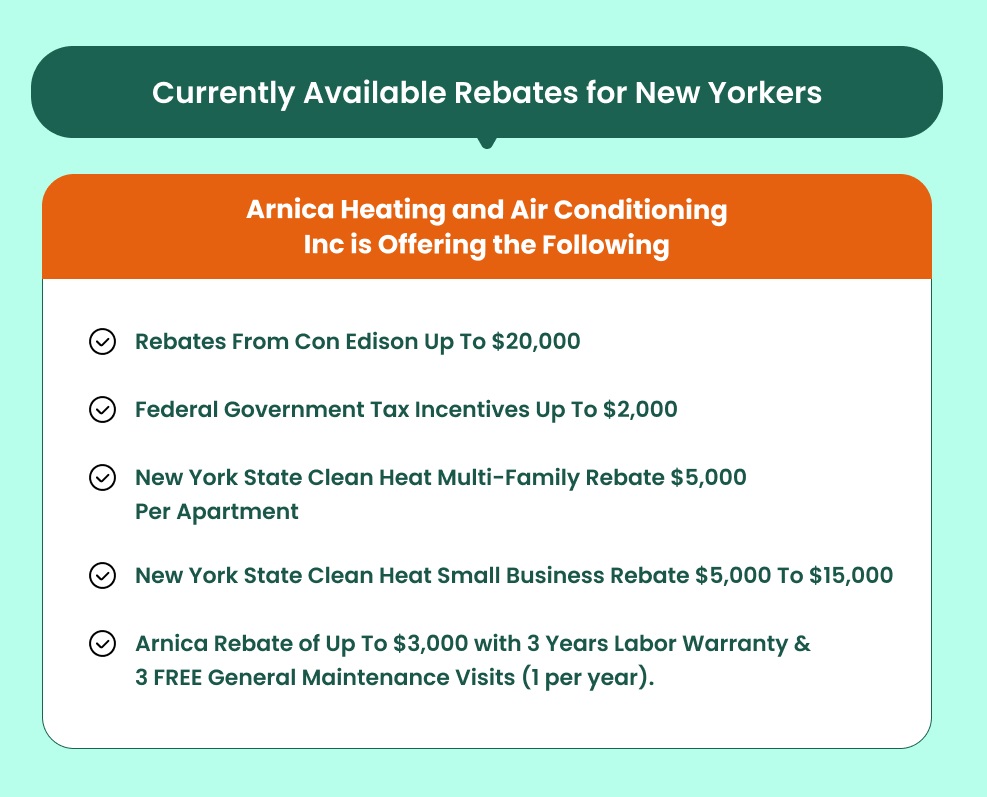

Here is a breakdown of the financial benefits of replacing your heating system:

1. Con Edison Rebates of up to $20,000:

Con Edison offers substantial incentives for eco-friendly heating systems. No matter if your business is small, you are renting, or you own a home, this refund can significantly reduce your initial costs for new heating systems.

2. Federal Tax Credit $2,000:

If you install a qualifying heating system, you could receive a $2,000 tax credit according to federal guidelines. This credit helps offset your annual taxes while promoting energy-efficient home upgrades.

3. Arnica Rebate $3,000:

Arnica offers a unique discount of up to $3,000 on heating installation in Queen, Manhattan, Staten Island, Brooklyn, and the surrounding areas. Their bundle includes 3-year labor warranty – Every year, you will have three complimentary general maintenance visits.

New York State Rebates for Clean Heat

For Multi-Family Buildings:

Thanks to the New York State Clean Heat Multi-Family Rebate Program, you could receive up to $5,000 for each apartment. This is ideal for property owners updating heating systems in multiple buildings.

For Small Businesses:

Rebates between $5,000 and $15,000 help small business owners transition to energy-efficient heating systems.

New Heating Installation in Staten Island and Queens

Heating projects in Queens and Staten Island have never been more affordable. By combining these excellent incentives, you can set up a modern heating system without any financial limitations. For example:

A Staten Island homeowner could save thousands of dollars by combining the $2,000 federal tax credit, $3,000 Arnica rebate, and up to $20,000 from Con Edison.

Small business owners in Queens can claim savings of up to $15,000 through the New York State Clean Heat Rebate.

Reasons to Choose Arnica for Your Heating Installation

Arnica is a reliable supplier for heating installation in Queens, Staten Island, and nearby areas. Choosing Arnica guarantees not only an energy-efficient heating source but also

Professional Installation Services:

With their labor warranty, you receive three years of reassurance. Three complimentary annual maintenance visits will ensure your system operates at its best.

Take Advantage of These Offers Now

Do not miss these important discounts for heating installation in Staten Island, Brooklyn, Manhattan, and Queens. Whether you own a small business, manage a property, or are a homeowner, these rebates and tax credits make upgrading your heating system an accessible and affordable option.

Take action today to benefit from a 3-year labor warranty and maintenance plan, along with $20,000 in Con Edison rebates, $2,000 federal tax credit, and up to $3,000 Arnica rebate. This winter, ensure your home or workplace is cozy and energy-efficient!

Over 35 years of experienced HVAC engineer and blogger with years of experience writing about various topics related to multiple types of HVAC systems installation, repair, and maintenance. I have been in this industry since my apprenticeship in 1985. Our team emphasizes quality workmanship while ensuring customer satisfaction is our top priority.

Leave a Reply

You must be logged in to post a comment.